- Joined

- Jul 28, 2018

- Location

- London

Discuss all things money; investments, debt, questions, tips and everything beyond and in between.

Back in 2008, in the midst of the financial crisis, I was lucky enough to be referred to a financial adviser when opening a student bank account. I ended up opening a stock ISA (savings account where the money goes into stocks and shares) and invested in it on a monthly basis for 7 years. I done it because I knew shares would be cheap and will bounce back, and they did. When I cashed it in to put a deposit down for my house, it was worth a good £3k or £4k more than what I out in. It equated to like a 40% interest rate or something like that.

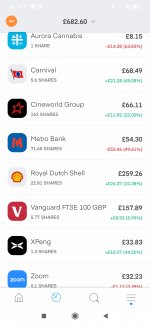

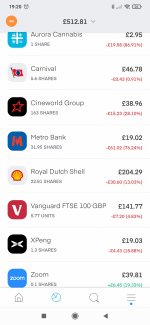

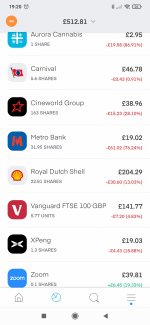

Anyways, as Covid hit I decided to start a little hobby investing my spare cash into stocks using Trading 212. Below is my performance so far and as you can see, I've lost money on everything but not concerned as these are companies who have taken a massive hit and I'm hoping they'll go back to normal within a couple years.

I didn't invest in other companies like Tesla, Amazon and Apple which have seen massive increases.

So in black is what I have invested and the red is the loss I've made with only one company, Zoom, turning a profit. Metro Bank were over 4,000p per share and has plummeted to around 60p. Investing any spare cash into there because even if they get to half of their peak, that will end up being a massive return.

Back in 2008, in the midst of the financial crisis, I was lucky enough to be referred to a financial adviser when opening a student bank account. I ended up opening a stock ISA (savings account where the money goes into stocks and shares) and invested in it on a monthly basis for 7 years. I done it because I knew shares would be cheap and will bounce back, and they did. When I cashed it in to put a deposit down for my house, it was worth a good £3k or £4k more than what I out in. It equated to like a 40% interest rate or something like that.

Anyways, as Covid hit I decided to start a little hobby investing my spare cash into stocks using Trading 212. Below is my performance so far and as you can see, I've lost money on everything but not concerned as these are companies who have taken a massive hit and I'm hoping they'll go back to normal within a couple years.

I didn't invest in other companies like Tesla, Amazon and Apple which have seen massive increases.

So in black is what I have invested and the red is the loss I've made with only one company, Zoom, turning a profit. Metro Bank were over 4,000p per share and has plummeted to around 60p. Investing any spare cash into there because even if they get to half of their peak, that will end up being a massive return.